Tax Status: 1099 vs. W-2

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons:

- You save more for retirement.

- You pay less tax.

Before we dive into the details, here’s a quick summary of the difference between the 1099 and W-2 tax forms.

When paid on a 1099 tax basis, you are considered an independent contractor. This makes you responsible for calculating and paying your own taxes quarterly. You also become eligible for certain business-owner tax deductions and retirement plans.

When paid on a W-2 tax basis, you are an employee of the company that pays you. Your taxes are automatically deducted from your paycheck and paid to the government through your employer of record.

Financially speaking, getting paid on a 1099 basis is much better, but it does take more work on your part. You must set yourself up as a business , manage your cash flow, and make quarterly tax payments. Here are the main advantages and disadvantages of the two payment methods.

Trade-offs of 1099 vs. W-2

| Considerations | 1099 Contract | W-2 |

|---|---|---|

| How frequently am I paid? | Varies, usually once a month or at end of contract | Every 2 weeks or twice a month |

| How long does it take to get paid? * | Varies by client, 15 days to over 60 days | No longer than one full pay period (usually 2 weeks) |

| Who makes tax payments to the government? | You do quarterly | The employer issuing your W-2 statement |

| Do I pay self-employment tax? | Yes | No |

| Can I contribute $54,000 or more per year to a retirement account? This usually more than makes up for paying self-employment tax. |

Yes | No |

Are expenses tax deductible?

|

Yes | No |

| Are benefits provided? For example: medical, dental, vision | No, but premiums are tax deductible | Sometimes but generally not tax deductible |

* Long payment terms by clients is one of the biggest annoyances of being self-employed. PICA hopes to change this! (Read more about Our Cause here)

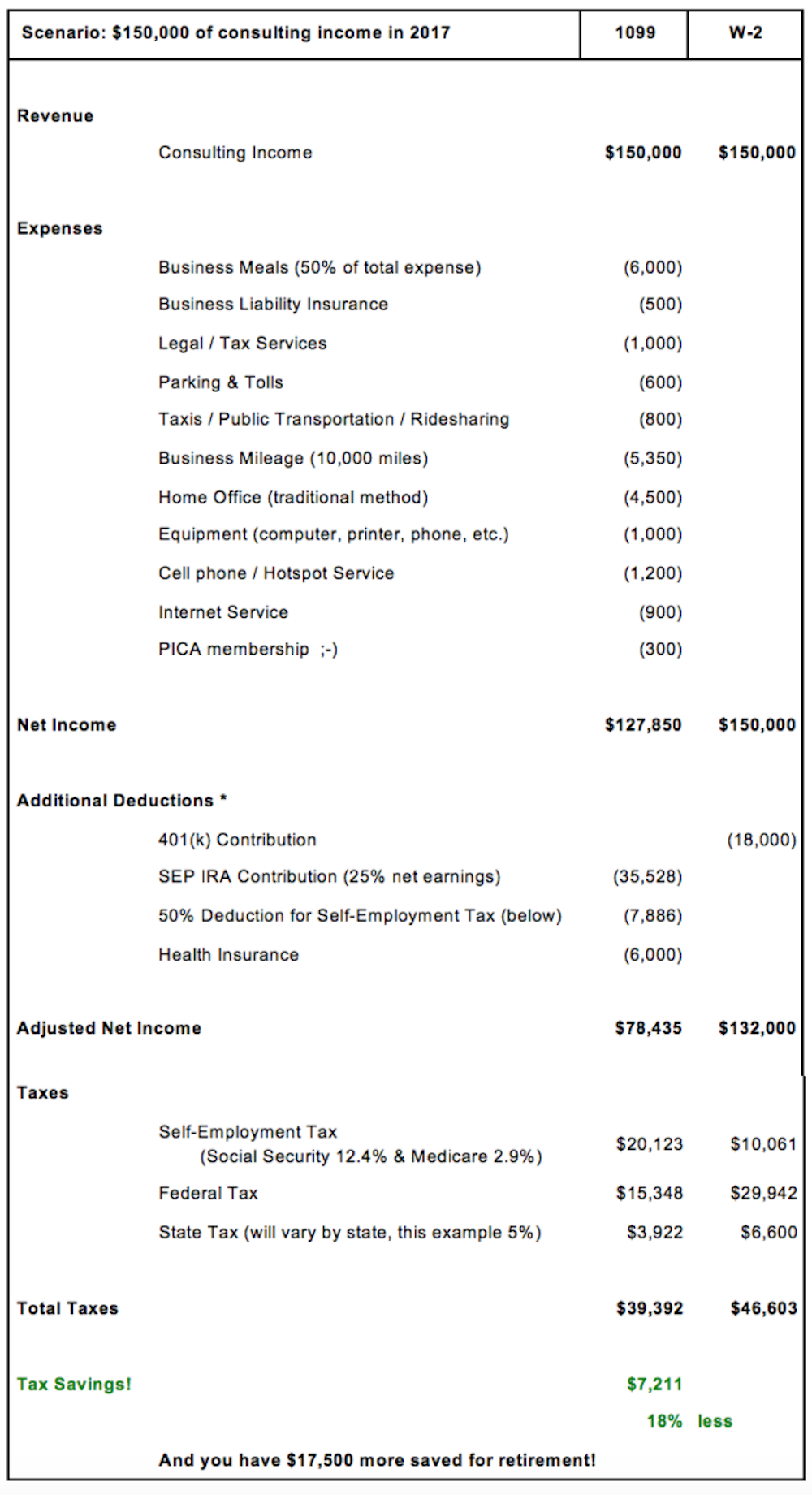

As a self-employed professional, you enjoy a distinct advantage getting paid on a 1099 tax basis. It gives you greater control over your tax situation, including opportunities to deduct business expenses, and allows for much higher pre-tax retirement savings. This simplified scenario illustrates these significant tax savings.

*For more information see SEP-IRA and Solo 401(k): Your Secret Sauce to Building Wealth

Paying $7,000 less in tax is significant! Of course, your savings will vary based on how much you earn, deduct, and save, but the numbers speak for themselves. The key ingredient is to put money into your retirement account; the more you save, the less tax you pay.

Tip: Put half of every paid invoice into a separate savings account earmarked for taxes and retirement. This should give you plenty of money for both.

Being paid on a 1099 basis and contributing more to your retirement account gives you the added advantage of growing your savings tax-free until you retire. That’s when you’ll likely be in a lower tax bracket because you’ll be earning less. This means the money you take out in retirement will be taxed at a lower rate than it would be now. So it’s a double bonus: you’re really paying less tax twice – on your current tax return now, and at a lower tax rate in retirement.

Like most good things, there’s a caveat. If you make less than $100,000 a year, the math may not work in your favor. Why? The self-employment tax. As a self-employed business owner, you have to pay the employer’s share of your Social Security and Medicare contribution (15.3% of your taxable income). This jumps to 16.2% if your gross income is greater than $200,000 in a calendar year. If you are paid on a W-2 basis as an employee, the company issuing the W-2 statement will pay this part of the tax for you.

For independent consultants to get the tax savings like those outlined in the $150,000 scenario detailed above, you need to have enough total income after business expenses to offset the employer’s tax contribution that you must pay. If you’re in doubt, talk with your tax professional. Otherwise, remember our motto: "Friends don't let friends W-2!"™

PICA's mission is to help you be successful. We want you to earn more and keep more!

Related Articles

- Setting Up a Foundation for Consulting Success

- Getting Started as Your Own Business

- Tax Overview

- SEP-IRA and Solo 401(k): Your Secret Sauce to Building Wealth

- Be Prepared for Quarterly Taxes

Related Events for PICA Members

- Navigating the Vendor Compliance Process (live webinar with Q&A)