Consultant, Contractor, Freelancer – Labels Matter!

Look at the ID badges of the workers in a typical large corporation, and you are likely to see different types. That’s one way companies distinguish their full-time, permanent employees from the large (and growing) population of contingent workers presumed to have no permanent relationship with the company. People with non-employee badges may be excluded from certain meetings, training courses, or even access to the company gym.

Some of these workers come from staffing agencies. Some contract with the client through the company’s vendor program. Others represent Big 4 consulting firms, IT vendors, or boutique consulting firms. Some of these non-employee workers may be there for months to develop or implement a certain program, and others may be there for just a day or two to teach a workshop.

There’s a lot of confusion over the status of these workers, with people performing jobs under different titles -- “contractors”, “consultants”, and “freelancers”, as well as “temps” who fill in for full-time employees on leave. You might even hear the terms used interchangeably for the same person or position.

For professional independent consultants, wading through the confusion is critical.

Positioning yourself the wrong way can limit your income, cost you thousands of dollars a year in taxes, stunt your professional development, and tie you unnecessarily to the traditional 9-to-5 routine.

Explicitly marketing yourself with the term “professional independent consultant” can increase the price you can command, and it can help you to be paid on a 1099 tax basis rather than on a W-2 basis. (Friends don’t let friends W-2!TM) Additionally, as an independent consultant, you will have discretion over the means and manner of your work. (Caveat: Just calling yourself a consultant doesn’t mean you won’t have to negotiate to keep your independent status. See our Vendor Compliance sectionfor more info.)

Understanding the Terms

At the end of the twentieth century, the differences between various roles were fairly well understood but over the last several years, the terms have been intermingled. Let’s set the record straight again.

-

Consultants give strategic advice and often lead complex projects. By definition, we stand outside of the system we analyze, troubleshoot, or design. Consultants are senior-level people, well-versed in the art and science of the domain in which we consult, be that change leadership or system architecture. Consultants often work full-time on a project for its duration or sometimes just for a day. We work with other people including company leaders, employees, and even other consultants, serving as a peer rather than a subordinate to the person accountable for the project’s success.

Employees of major consulting firms like McKinsey and Accenture are called consultants, as are some in-house specialists deployed in an advisory role to work with teams outside of their own reporting structure (for example, an internal change management consultant). By contrast, professional independent consultants operate as microbusinesses. As solopreneurs, we deliver services under a statement of work and are paid on a 1099 tax basis. We are independent contractors rather than employees.

- Freelancers use artistic or technical skill to generate work products. Freelancers make things you can point to such as blocks of code, brochures, or logos. Since they work on projects that are more narrowly focused than consultants do, freelancers typically work on more than one project at a time. During a given month, a freelance writer might tackle a newsletter for a nonprofit, content for a small business web site, and a procedure manual for a global corporation, working on each for a few hours or a few days at a time.

Freelancers direct their own work and are usually paid by the job. Like independent consultants, they often operate as microbusinesses, and are hired as independent contractors rather than employees.

- Contractors are short-term workers brought in to complete a specific set of tasks. They tend to do more tactical work, as opposed to the strategic problem solving of consultants or the creative production of freelancers. Legally, they may be independent contractors (definition below), but they’re nearly always hired as temporary workers through a third party (like a staffing agency) and they’re paid on a W-2 tax basis. To make it even more confusing, sometimes employees of major consulting firms do this type of hands-on work, but they’re still called consultants.

- Temps (temporary workers) fulfill routine employee work on an interim basis. If a company’s accountant or receptionist goes out on parental leave, the work still needs to be done. The work is usually routine, with little variation from one employer to the next. Sometimes temp work becomes permanent when the absent employee chooses not to return to the job, or if the company decides to add an additional position.

Temps are literally temporary employees. Their employer is the staffing agency, which acts like a dispatcher.

The 21st century brings an addition to the list:

- Gig workers complete one task or job at a time, usually for minutes or a few hours. They are found and hired through a third-party app or service like TaskRabbit or Uber. Whether gig workers should be paid as employees or as independent contractors is currently being fought out in the courts.

The contingent workforce is a catch-all term for all non-employee workers, including every type of worker defined in here.

It’s especially important to understand another critical term that is neither a label nor a role, but rather a legal classification: independent contractor.

An independent contractor is a person, business, or corporation that provides goods or services to a client under terms specified in a contract or verbal agreement. Independent contractors are paid on a 1099 tax basis (sometimes called a corp-to-corp basis) as opposed to being paid on a W-2 tax basis like an employee.v(Note: Don’t ever rely on a verbal agreement! Be sure to read "The ABC's of Contracting").

Independent contractor is a distinct term. It's not interchangeable with independent consultant. Being classified as an independent contractor has to do with how you are paid and how you pay your taxes. Not all independent contractors are consultants, and not all independent consultants qualify as independent contractors. (See vendor compliance for more info.) As a professional independent consultant, you definitely want to be paid as an independent contractor. (Friends don't let friends W-2!TM)

When you read the definitions of these terms in one place, it all starts to make sense. But to the general public, and most clients, it’s clear as mud. Part of the problem is that when staffing agencies recruit workers, they often use the term “consultant” for all types of roles because it sounds more professional. Moreover, bloggers and journalists often misuse the terms too. The definitions have become fuzzy and intermingled. It’s important that we set the record straight so we’re hired and respected as business owners.

What You Call Yourself Matters

Clearly, we have a point of view about calling yourself an independent consultant, but we want to caution you too. How you label yourself influences how people will perceive you. Stereotypes and assumptions are rampant and inconsistent:

"Consultants just talk a lot of theory. They don’t actually do anything.”

“Consultants charge more than contractors for the same work.”

“Freelancers are less expensive than contractors.”

“Freelancers are more expensive than contractors.”

“Contractors are less educated and less experienced than consultants.”

“Contractors want to be hired as ‘real’ employees.”

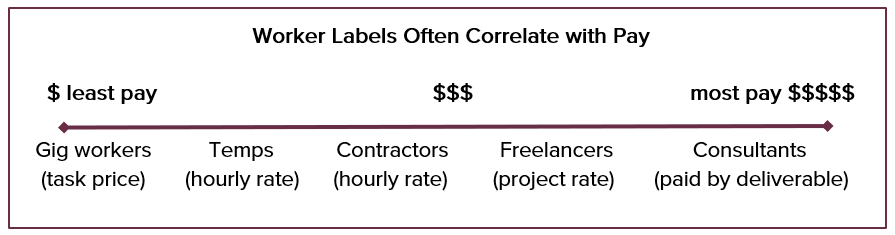

Additionally, hiring managers and clients associate certain pay ranges with the various labels.

Perhaps most importantly, your “job title” will likely impact how you are hired and paid. Corporations are likely to hire contractors and freelancers through a third-party staffing firm, who usually pays these workers on a W-2 tax basis. As a self-employed professional, no matter what you call yourself, you’re likely leaving money on the table if you are paid on a W-2 basis.